NACS State of the Industry Summit data reveals that foodservice sales accounted for 22.5% of in-store sales in 2017

By NACS Online

U.S. convenience stores experienced a 15th straight year of record in-store sales, with in-store sales increasing 1.7% to a record $237.0 billion in 2017, per recently release NACS State of the Industry data announced last month. The last time the U.S. convenience store industry reported a decrease in in-store sales was 2002, when sales dropped 2.4%.

“Foodservice is our industry’s biggest opportunity,” said NACS Research Committee member Alan Beach (formerly of 7-Eleven Inc.) while revealing the industry’s 2017 benchmarks at the NACS State of the Industry Summit.

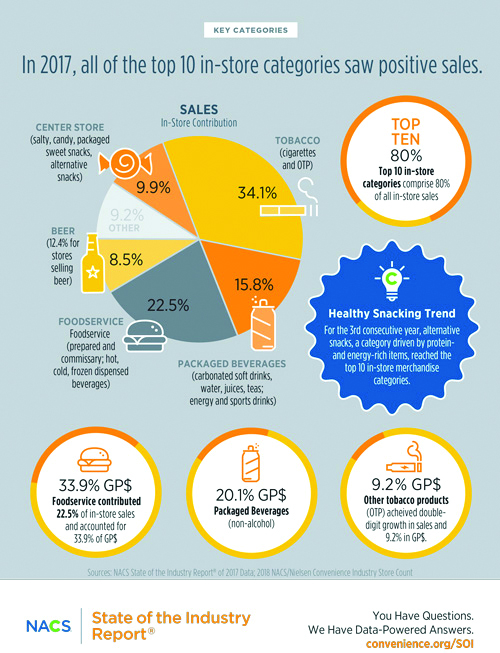

In-store growth in 2017 was powered by foodservice, a broad category that mostly includes prepared food (69% of both category sales and profits) but also commissary foods and hot, cold and frozen dispensed beverages. Foodservice accounted for 22.5% of in-store sales and 33.9% of gross profit dollars. The category also was the biggest differentiator in terms of profits: top-quartile performers had prepared food sales that were 3.6 times greater than bottom-quartile stores; coffee sales at top performers were 5.2 times greater that than those of the bottom quartile.

While tobacco products, including cigarettes, cumulatively were 34.1% of in-store sales dollars, they accounted for only 17.1% of gross profit dollars. Cigarette sales accounted for 28.6% of in-store sales dollars, a sharp decline from 36.9% in 2011. Meanwhile, the category other tobacco products (OTP) was a bright spot, with an 11.2% increase in sales dollars and an 9.2% increase in gross profit dollars.

While tobacco products, including cigarettes, cumulatively were 34.1% of in-store sales dollars, they accounted for only 17.1% of gross profit dollars. Cigarette sales accounted for 28.6% of in-store sales dollars, a sharp decline from 36.9% in 2011. Meanwhile, the category other tobacco products (OTP) was a bright spot, with an 11.2% increase in sales dollars and an 9.2% increase in gross profit dollars.

Packaged beverages (non-alcohol) accounted for 15.8% of revenue dollars and 20.1% of gross profit dollars. Within the category, enhanced water saw the strongest sales increase (9.1%); ready-to-drink iced teas (3.5%), alternative beverages (3.5%) and bottled water (0.6%) also posted sales increases, continuing the trend of consumers seeking more healthier and/or functional beverage options at convenience stores.

Snacking categories all had sales growth, as salty snacks (up 5.6%), candy (up 2.6%) and alternative snacks (up 2.0%) all had strong growth as some consumers, especially millennials, moved toward snacking and away from traditional meals. This was the second consecutive year that alternative snacks, a category driven by protein- and energy-rich items, reached the top 10 in-store merchandise categories, signaling a growing desire by consumers for immediate/healthier snacking options.

For more a complete analysis on retail fueling at convenience stores, pre-order your copyof the NACS State of the Industry Report of 2017 Data. Available in June, the report is the convenience and fuel retailing industry’s premier benchmarking tool—delivering insightful, useful information about the industry to retailers maximize their effectiveness and profitability.